|

Recently, Alex Guberman from E for Electric published a somewhat sheepish video wherein he admitted that "Tesla may not be doomed after all." The May sales numbers for EVs, plug-in hybrids, and soft hybrids had just been published by Inside EVs, and they looked particularly good for Tesla... but perhaps not so great for those who, for whatever reason, like to spread fear, uncertainty, and doubt about Tesla. (These folks are affectionately known as FUDsters in the industry.) Of course, in the industry, I suppose I would be dubbed a Tesla "Fanboy," so my opinion could certainly be perceived as biased. Fair enough. But let's look at something that's not biased: numbers. Specifically, lets look at the US sales data for EVs, plug-in hybrids, and soft hybrids for just the month of May, 2019. As I said, these numbers come from InsideEVs, who consistently do a great job of gathering and publishing sales numbers for automobiles in the electric and hybrid sector.

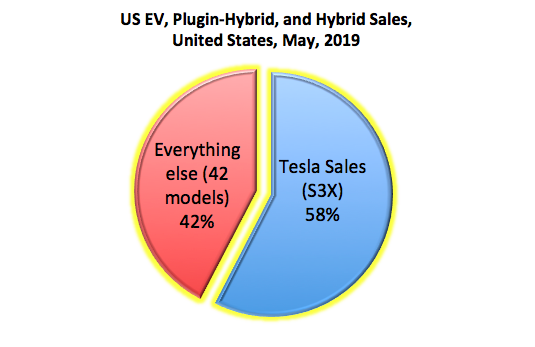

The reasons for Tesla's strong sales results are many, but I thought I would share some of them with you here, as well as a rather interesting fact I found when I analyzed the sales numbers for the month of May. First, let me confess that I told Alex, in the comments posted below his video, that he's funny. I pointed out that he talks about Tesla as if it "may" not be doomed after all (which, in Alex's defence, may have been sarcasm as opposed to a solemn admission), and I suggested that Alex - and everyone else - take Elon's advice when analyzing Tesla: start from first principles. First Principles, as they Apply to the EV market Principle #1: EVs are the new mode of personal transportation. Electric vehicles are replacing the internal combustion engine. This is now perfectly clear. You don't need to take my word for it: even the presidents and CEOs of the top legacy automobile manufacturers are now admitting this as they scramble to catch up in the EV market. This past December, after announcing the impending closure of the GM plant in Oshawa, Ontario, Travis Hester, the president of GM Canada, said that "EVs are the future." This past February, Honda CEO Takahiro Hachigo, announced that Honda would be closing its plants in England and Turkey as they restructure for electrification. He stated, "We have decided to carry out this production realignment in Europe in light of our efforts to optimize production allocation and production capacity globally as well as accelerating electrification." Just two days ago, in a Tokyo press conference, Executive Vice President of Toyota, Shigeki Terashi, confessed that, "Demand for electric vehicles has grown stronger than we had projected." Toyota, who had been the industry laggard in bringing EVs to market (even making fun of electric vehicles in their advertising up until very recently), has now announced that they are pushing their EV program five years ahead of schedule. Principle #2: In the EV market, Tesla is the juggernaut. Compared to Tesla, all of the other original equipment manufacturers (OEMs) are producing paltry numbers of units, and they are offering products that are having a very hard time competing with the products offered by Tesla. I will present more on this below, as I dissect the US sales numbers for the first five months of 2019. Principle #3: Tesla has a huge first-move advantage. In both electric vehicles and autonomous driving, Tesla has years of lead time on other OEMs. Very recently, ARC Invest stated that Tesla is easily a few years ahead of their competition. Tesla only needs to stay about one year ahead of the competition to have an overwhelming advantage. However, the harsh reality for all other car companies is this: Tesla only needs to stay about one year ahead of the competition to have an overwhelming advantage. At any given point in time, once a consumer makes the decision to buy an EV, what are they going to buy: the most advanced electric vehicle available with the longest track record of success, or something else? You tell me. A Deeper Dive into the Sales Numbers I took the liberty of copying and pasting the data provided by InsideEVs into a spreadsheet so that I could work with the numbers. (That spreadsheet is available to be downloaded at the bottom of this article.) I was curious to put these numbers into perspective, so I decided to add up the sales for Tesla Models S, 3, and X, and then compare those numbers to all the other models available in the US EV, plugin-hybrid, and soft hybrid market. Here's what I found.

If that doesn't put things into a rather stark perspective, then I'm not sure what will. In Summary With companies like Toyota already conceding defeat to Tesla, it's pretty difficult to imagine Tesla's competition doing very well ten years from now. Tesla never planned to take over the automobile market. Their mission is, and always has been, to accelerate the world’s transition to sustainable energy. Ironically, that means that Tesla is motivated to make their cars the most compelling vehicles on the planet, and to keep their customers driving their electric vehicles for a million miles. Undoubtedly, this is a very difficult value proposition for traditional car companies to compete with. Manufacturers of automobiles powered by internal combustion engines are invariably falling victim to the biggest disruption since the gas-powered automobile replaced the horse and carriage. These traditional car manufacturers have always depended on dealerships, maintenance and service fees, and possibly even planned obsolescence to drive their revenues. Now they have to compete with a company that has a deeper purpose than just earning money, and a longer-term vision than just the next quarter's financials. I truly hope that the traditional car manufacturers do learn to adapt and survive in the emerging era of electrified transportation. After all, as much as I admire Elon Musk and Tesla, one relatively new company cannot possibly facilitate the transition to electrification as quickly as the world needs it to happen. We're going to need all of the world's major automobile manufacturers to come out with strong EV sales numbers every single year for the next ten years if we are to achieve the monumental task that the Intergovernmental Panel on Climate Change outlined in its 2018 Climate Change Report. However, it is now becoming painfully clear that the traditional automobile manufacturers are going to be facing an increasingly uphill battle as they set out to compete in this rapidly evolving market. Update: It is currently Sunday, December 29th, 2019: approximately six months after I wrote this article. Tesla's Shanghai Gigafactory is up and running, and it is rumoured to be currently producing 1000 cars a week. A company spokesperson recently stated that Tesla is set to begin deliveries of its first China-made Model 3 cars on December 30th... just 357 days after the company started construction of its Shanghai factory in an empty field. Tesla's stock price has risen meteorically in recent weeks, finding its way to a new all-time high of $430.00 a share. This makes Tesla by far the highest valued American automobile manufacturer by market capitalization. It also makes Tesla the third highest valued automobile manufacturer in the world, with only Volkswagon and Toyota commanding higher values in the stock market. Tesla could very well be within days of rolling out their first feature-complete version of full-self driving, potentially beating the world to this mark by years. To say that Tesla's growth is both unprecedented and unparalleled would be an understatement. Indeed, the world has never seen anything like this. At this date, my predictions for Tesla remain unchanged. Given its current trajectory, Tesla will likely be the only automobile manufacturer producing any substantial number of automobiles nine and a half years from now.

1 Comment

Leave a Reply. |

Green NeighbourWhen it comes to the environment, we are all neighbours. Archives

November 2022

Categories

All

|

|||||||||||||

RSS Feed

RSS Feed